Akurateco delivers advanced real-time reporting, smart routing, fraud prevention, and full white-label payment processing tools for scalable, data-driven growth.

In today’s fast-paced digital economy, businesses need payment processing solutions that not only ensure seamless transactions but also offer continuous insight into all payment activities. As companies expand globally, adopt new payment methods, and manage increasing transaction volumes, the need for intelligent, data-driven systems becomes essential. For organizations aiming to build or scale a payment business without investing years into development, white label fintech software provides a strategic advantage. Among leading players in this space, Akurateco stands out by delivering advanced real-time reporting, deep analytics, and a full suite of payment orchestration tools designed to optimize performance at every level.

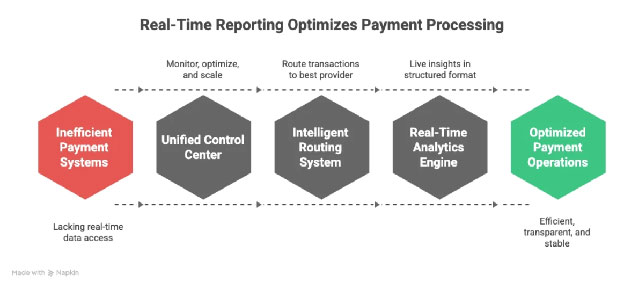

Payment reporting has evolved far beyond basic transaction logs. Today, it is a central component of risk management, performance optimization, compliance monitoring, and strategic decision-making. Businesses that fail to implement real-time data visibility risk revenue losses, fraud exposure, and operational downtime — issues that can be avoided with modern, high-performing fintech infrastructure.

Real-time reporting plays a critical role in ensuring payment systems operate efficiently and transparently. Immediate access to data allows businesses to react instantly to changes in authorization rates, provider availability, fraud attempts, or checkout errors. When a transaction fails, declines spike unexpectedly, or a payment provider experiences downtime, companies equipped with real-time analytics can address issues before they escalate. This capability directly influences profitability, customer satisfaction, and the overall stability of a payment operation.

For entrepreneurs and PSPs planning to start online payment processing company operations, real-time reporting becomes a core building block. It creates the environment in which routing strategies can evolve dynamically, fraud can be mitigated instantly, and merchant support teams can work with precision. Without accurate and immediate reporting, even advanced systems lose their competitive relevance.

Akurateco has established itself as a leading fintech platform by offering real-time reporting embedded into every component of its white-label payment infrastructure. Built by industry veterans with over 50 years of combined experience, the system provides a unified environment where payment providers, merchants, banks, and marketplaces can monitor, optimize, and scale payment operations from a single control center.

The platform aggregates data from more than 600 global and local payment integrations, making it possible to visualize approval rates, settlement statuses, routing performance, subscription activity, and risk patterns in real time. Instead of managing multiple dashboards and scattered data sources, businesses rely on Akurateco’s analytics engine, which presents live insights in a structured and actionable format. With this level of transparency, companies gain the clarity needed to solve operational issues quickly and boost overall financial performance.

Akurateco’s intelligent routing system works hand in hand with real-time reporting insights. Each transaction is analyzed and directed to the most suitable payment provider based on geography, currency, risk level, and historical performance. When approval rates shift or a provider experiences instability, the routing logic can adapt immediately, ensuring higher conversion rates and reducing unnecessary declines. This automated optimization, combined with real-time analytics, creates a feedback loop that continuously improves transaction outcomes. Businesses can observe how routing strategies affect performance and refine their logic accordingly.

Fraud detection and risk management depend heavily on the speed and accuracy of reporting. Akurateco’s real-time monitoring capabilities allow companies to detect unusual behavior instantly, apply dynamic rules, and block fraudulent attempts before they impact revenue. By combining behavioral analysis, velocity checks, device fingerprinting, and automated chargeback alerts, the platform ensures that risk mitigation is not delayed. The immediacy of data empowers businesses to respond to threats proactively, strengthening the trust of both merchants and end customers.

For subscription-based businesses, recurring payment visibility is crucial. Akurateco enables companies to track renewals, failed attempts, retry outcomes, and customer churn factors as they happen. Real-time data helps businesses adjust billing strategies, optimize retry logic, and identify friction points in the subscription lifecycle. These insights turn subscription management into a revenue optimization tool rather than a simple billing mechanism.

Payment providers using Akurateco benefit from real-time reporting tools that support merchant onboarding, account monitoring, compliance checks, and operational control. Providers can track merchant performance, identify anomalies, manage limits, and analyze behavior patterns without relying on outdated or static reports. This helps PSPs scale quickly and confidently while maintaining high regulatory and technical standards.

Akurateco stands out in the global payment technology landscape because it combines deep technical expertise, industry-leading analytics, and a flexible deployment model that adapts to any business scenario. The platform was built from the ground up as a comprehensive ecosystem, not a collection of isolated tools, which means real-time reporting is not just a feature — it is an integral part of every transaction, every routing rule, every merchant onboarding flow, and every fraud prevention mechanism.

Businesses choose Akurateco because it delivers a level of transparency and operational control that traditional gateways and PSP infrastructures cannot match. The real-time analytics engine provides continuous visibility into approval trends, error codes, provider outages, billing cycles, fraud patterns, and customer behavior. This allows businesses to make decisions based on live data rather than historical summaries. Payments become predictable, manageable, and measurable.

Another advantage is Akurateco’s flexibility. Companies can choose between SaaS, on-premises, and cloud-agnostic deployments, ensuring compliance with local regulations and internal security requirements. The platform is fully brandable, allowing providers to maintain a strong identity while offering enterprise-grade technology under their own name. Its modular architecture means that businesses can start with core payment processing and gradually expand into more sophisticated capabilities like subscription management, PayFac-as-a-Service, custom integrations, and advanced fraud tools.

Akurateco’s PCI DSS Level 1 certification, GDPR compliance, and robust security architecture give businesses confidence that their data is protected at every stage. But what truly differentiates Akurateco is its “Payment Team as a Service” — a dedicated group of payment experts who help clients optimize their approval rates, refine routing logic, interpret analytics, and solve complex operational challenges. This combination of advanced technology and human expertise creates a unique environment where clients not only access powerful tools but also gain strategic guidance.

In essence, Akurateco delivers everything a modern payment provider or merchant needs: a unified reporting system, a powerful orchestration engine, real-time routing optimization, intelligent risk controls, and unmatched scalability. The result is a platform that not only processes payments but actively improves business performance through data-driven insights.

Real-time reporting is no longer a luxury — it is a necessity in a competitive and rapidly evolving digital payments market. Businesses that embrace real-time insights gain control over approval rates, operational risks, merchant performance, and customer experience. Akurateco sets the industry standard by offering a comprehensive white-label payment ecosystem designed around the principles of transparency, optimization, and scalability.

For companies seeking to launch or expand a payment business, Akurateco provides the foundation to do so efficiently, securely, and intelligently. With powerful real-time reporting at its core, the platform enables faster growth, better decision-making, and stronger financial outcomes. It is the ideal solution for businesses ready to elevate their payment operations and unlock the true potential of data-driven fintech innovation.

Discover our other works at the following sites:

© 2026 Danetsoft. Powered by HTMLy